Revenue isn't a sales problem

Revenue stalls and you look at sales. The instinct makes sense. Sales is where the data lives. Pipeline, conversion rates, win/loss. You can measure it. You can see which deals died and when. You can at least point at a rep and ask what happened.

Sales is also hirable. When revenue is the problem, hiring a rep or a sales leader is doing something. It’s a concrete move. The board sees action. You see action. It feels like momentum, even when nothing upstream has changed.

But most early-stage revenue problems don’t live in sales. They surface there, sure, and the visibility of sales makes it the obvious target. However, the actual constraint usually sits elsewhere, invisible. CB Insights found 42% of startup failures trace to no market need—not sales, not funding, not competition.

The dependency chain

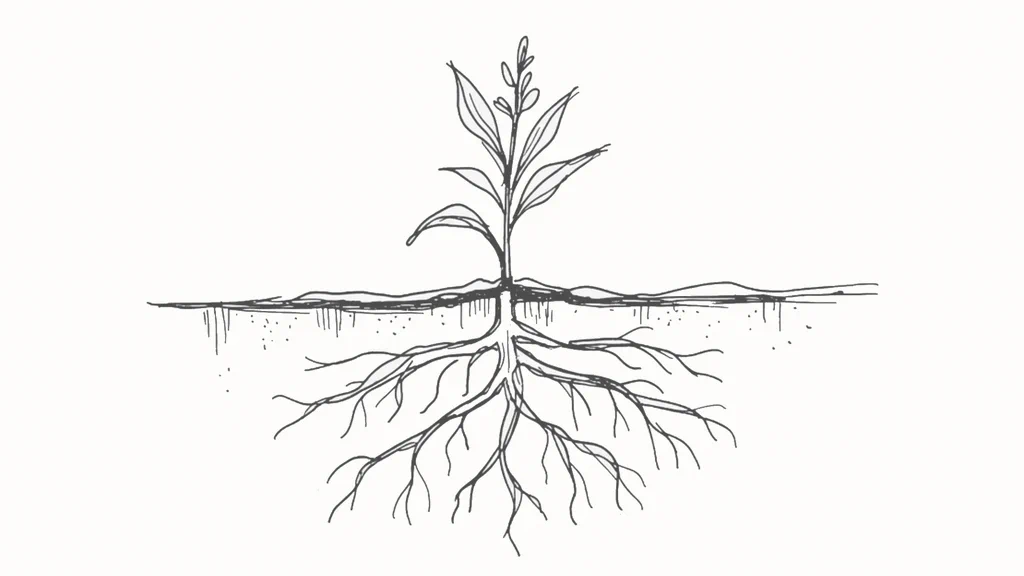

You can’t close deals if buyers can’t explain what you do. You can’t position your product if you don’t know who actually buys. The sequence: market clarity, positioning, sales motion. Break a link upstream and everything downstream fails.

When positioning is broken, sales training doesn’t help. Your reps aren’t struggling because they lack technique. They’re struggling because buyers don’t understand the product well enough to say yes, or to explain the purchase internally. The champion who loves your demo can’t articulate the value to their CFO. It looks like a closing problem. It isn’t. Positioning failed, and you’re seeing the result.

When market clarity is broken—when you don’t actually know who buys or why—positioning can’t work. You’re crafting messages for a buyer you’ve imagined, not one you’ve validated. The pitch sounds good. It just doesn’t land with anyone real. You iterate on messaging when you should be iterating on who you’re talking to.

I’ve watched companies churn through multiple sales hires in a single year, convinced each one was the problem. Pipeline existed. Demos happened. Deals died. The diagnosis was always “sales execution.” The actual issue was that nobody—not the founders, not the reps, not the buyers—could explain what the product did in terms that mattered to the person writing the check.

Most revenue problems, especially under two million ARR, live one or two layers higher from where they show up. You see the lost deal. You don’t see the confusion that killed it three conversations earlier.

What this looks like

Bitcoin companies walk into this constantly. Mission creates conviction that demand exists. Technical superiority feels like it should be enough. “Bitcoin fixes this” is true, but it’s not a value prop.

When the protocol’s truth is obvious to you, translating it into buyer language feels redundant. Why explain that trustless verification matters? Why justify removing counterparty risk? But the buyer doesn’t share your priors. They’re not evaluating your product against the fiat system. They’re evaluating it against their current vendor, their current workflow, their current budget. The work isn’t explaining Bitcoin. It’s explaining what your product does for someone who doesn’t already believe.

That translation is positioning. Skip it and sales inherits an impossible job. You end up blaming their close rate when the real problem was the conversation they inherited.

The questions that locate it

Start with buyers. Can they explain what you do? Not your team: actual prospects, in their words. If the answer comes back vague or wrong, positioning is the constraint. No amount of sales effort will fix a message that doesn’t stick.

Next, look at your losses. Are you losing to competitors or to confusion? Both show up as lost deals, but they point to different problems. Competitor losses mean your pitch needs sharpening: you were understood and rejected. Confusion losses mean buyers never understood enough to compare. They didn’t choose someone else; they chose nothing, or they went back to what they already had. The first is a sales problem. The second is not.

Finally, examine your pipeline. Is it wrong-fit or unconverted right-fit? Wrong-fit pipeline means market clarity broke: you’re attracting the wrong buyers because you don’t know the right ones. You’ll see lots of first calls that go nowhere. Right-fit pipeline that won’t close points back to positioning: the buyers match your target, but something in how you’re explaining the product is failing them. The fix for wrong-fit pipeline isn’t pushing harder, it’s disqualifying earlier. A smaller pipeline of real buyers beats a full one that goes nowhere.

Treating symptoms without finding the cause just burns runway.

What changes when you see it

Consider the sales hire. The one who succeeds inherits clarity. They don’t have to guess what the product does or who it’s for. They can sell because the foundation holds. The one who fails walks into fog and navigates by instinct. Same person, different outcomes, depending entirely on what they inherited. If you’ve watched a good rep flame out at a company with broken positioning, you’ve seen this play out.

Sales matters. But sales is the final stretch, and if the track is broken, faster runners won’t help.

This keeps happening because sales is visible and positioning is invisible. Lost deals show up in the CRM. Pipeline has a number. Positioning doesn’t have a dashboard. The constraint that’s actually killing revenue doesn’t announce itself. You have to go looking.

Learn to see upstream. Find where the chain breaks. Fix that first.